This is your brain on money - a lesson about stress, emotions, and money that no one else will teach you

When stress and emotions run high, our logical (thinking) brain can get hijacked and it can lead to very costly financial decisions

Time to read: 8 min.

“You aren’t responsible for your first thought but you are responsible for your second thought and first action.” - Kristen Bell

I’ll come back to this quote at the end of this post.

Have you ever made a decision and 3 days, 3 weeks, or 3 months later looked back and said to yourself…

“What the heck was I thinking!?”

You know what? That’s the wrong question. Let me try this again.

When was the last time you made a decision and then some time later looked back and said to yourself, “What the heck was I thinking!?”

If we are being honest with ourselves, we have all done this. Some of us many times over.

Don’t worry. I’m not here to tell you that you should feel ashamed for making a poor financial decision. I think we all tell ourselves that enough. We all carry some level of guilt, shame, embarrassment, or disappointment about the financial choices we make and/or the situation we find ourselves in.

I’m here to tell you that you are human and that you are normal. In fact, 250 million years of evolution have programmed us to operate this way. That’s a lot of evolution to overcome.

I’ll explain this more in a bit.

However, this is a valuable lesson you need to learn because those who don’t will continue to make very costly financial mistakes, and they may never know why they can’t achieve financial success or build meaningful wealth.

The good news is that I want you, and everyone else, to achieve financial success so I am going to teach you a lesson that very, very few financial advisors will ever know or tell you.

The amygdala hijack and the cause of (many) poor financial decisions

Now, reality check. I am not a psychologist or a neuroscientist, but I am a behavioral finance expert so I’m going to keep this high level.

When we experience strong emotions, we may not notice that our thinking brain or our executive functions change. There’s no automatic alert system in our brain that says, “Hey! Logic and reason are offline!”

As a result, many people continue to make decisions (and believe they are making rational choices) even when in a heightened emotional state.

However, what’s happening when we experience heightened emotions – both positive emotions like love and excitement and negative emotions like sadness and fear – is that we enter a fight, flight or freeze state of mind. And, in this state, the higher level thinking part of our brain can go offline.

The interesting thing is that we can still think we are thinking, but, in reality, our thinking brain can be severely impaired. As a result, we can make very poor and unhealthy financial decisions.

Quick aside, our brains react to stress in much the same way that it reacts to heightened emotional states. Stress can short circuit our higher level thinking brain and make our emotions the primary driver of our decisions.

Our emotions, and our emotional response to stress, is processed in our amygdala. When the amygdala gets activated, it hijacks how we think. The amygdala is also where we process and regulate our behavioral responses. So, if left unchecked, it will quite literally drive our behaviors (actions, decisions, and choices).

And this is what psychologists call the Amygdala Hijack.

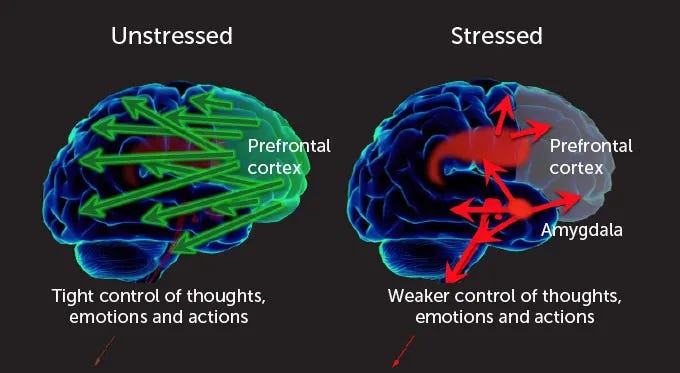

Here’s a simple illustration to highlight what happens in our brains when affected by emotions and stress.

Source: https://www.sciencenews.org/article/coronavirus-covid19-stress-brain

When we aren’t stressed or in a highly emotional state of mind, our higher level thinking brain is online and helps us make better decisions. When we are stressed or faced with a decision that elicits a strong emotion, our brain simply gets confused and starts to send mixed signals.

—-

Here’s another way to think about the power of the amygdala which resides in the limbic system. The limbic system started to develop around 250 million years ago. Comparatively, the “human-like” way of thinking (executive function, cognition, etc) developed only around 2 million years ago (that’s about 1% of the evolutionary timeline as the limbic system).

So imagine you are betting on two runners in a marathon. Runner A has been training for an entire year (365 days). Runner B pretty much woke up 3 days ago (roughly 1% of 365) and signed up for the race. Who do you think will win?

If it isn’t clear, Runner A is our limbic system and Runner B is the neocortex. There’s a very clear winner.

What emotional states mean for financial decision making

In a strange twist of fate, it turns out that emotions are necessary for good decision making. In fact, they can lead to higher levels of motivation and help us take action. So we can’t just ignore our emotions or try to make decisions without them.

But if emotions are both good and bad, what are we to do?

The key to balancing emotions and healthier financial decisions is two-fold; awareness and regulation. Awareness simply means allowing yourself to be present in any moment and to feel the emotion as it rises and as it fades away. The first step of being aware of the emotion is huge because you are then capable of knowing that this emotion can, and most likely will, hijack your thinking process. From there, the key is to allow yourself to come back into a more calm emotional state (regulation).

Now, keep in mind that we can still make good decisions even when our emotions are running high, but it is much harder to do so. My take, after seeing this for 20 years as a financial advisor, is to give yourself some time to let the intensity of the emotion subside.

I’ll repeat that → During periods of heightened emotions or stress, try to avoid making big financial decisions. Trust me. You will thank me for this.

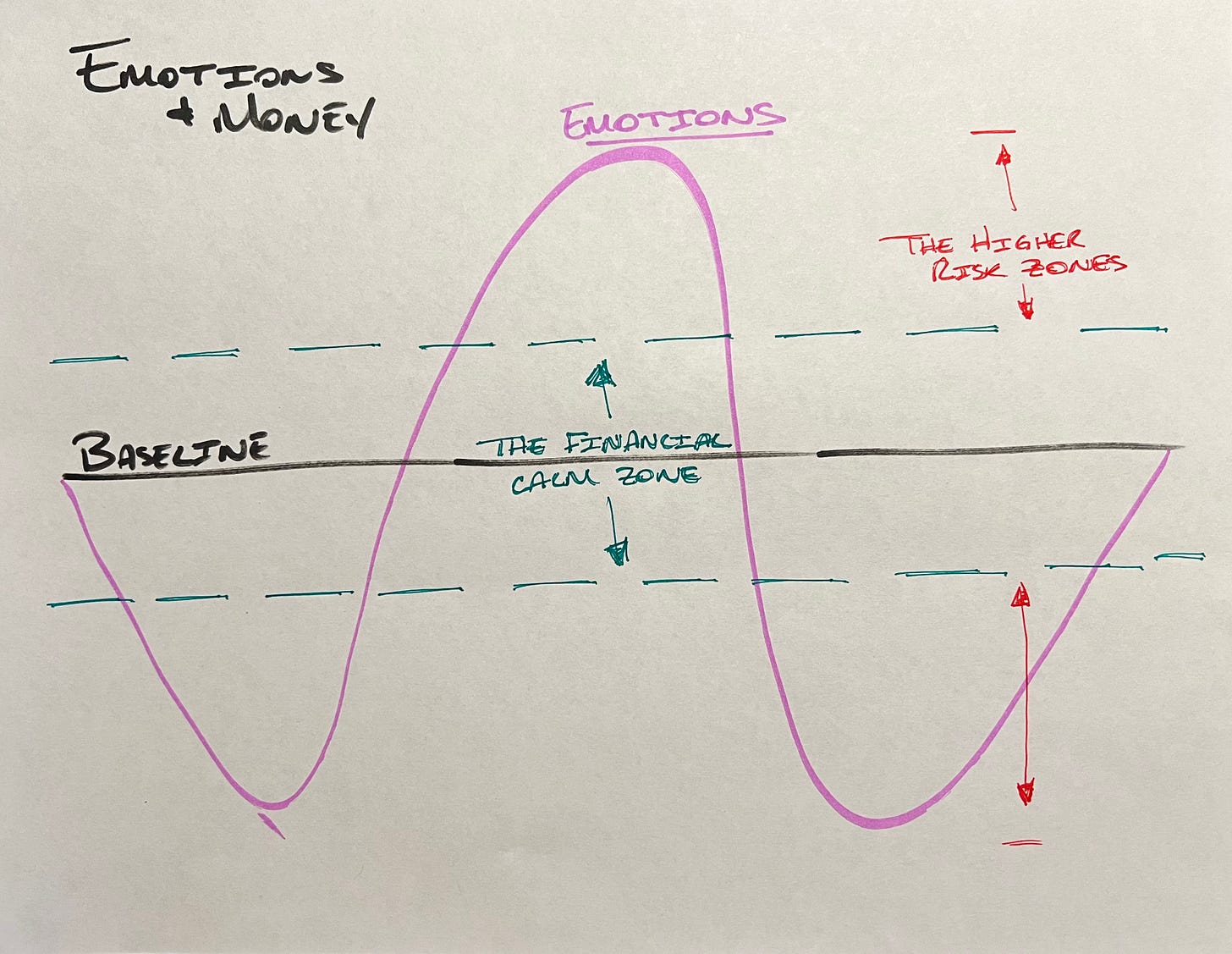

Here’s a little visual for you that shows the rolling state of emotions over time. Don’t laugh at my lack of artistic abilities.

Now, this isn’t a scientific explanation but it is an accurate representation of when we tend to make healthy vs unhealthy financial decisions. The closer an emotion is to an extreme, both high and low (the red/”higher risk” zone), the closer we are to our logical, rational brain going offline or at least being severely impaired.

And, trust me, you will make a decision when in a heightened emotional state and you will think you are thinking and making a smart decision and then you will try like heck to justify it with logic and you will convince yourself you made the right decision (yes, that’s a run-on sentence and I used it on purpose).

And 3 to 6 months later, you will look at yourself in the mirror and say, “what the heck was I thinking when I made that decision?!?!?”

Welcome to the amygdala hijack.

Key point here → don’t beat yourself up or think you aren’t capable of managing your finances or making smart decisions. You are human, and we all get hijacked at some point. I’ve seen it for 20 years:

People get married, have kids, get promoted, (enter a positive emotional event of your choice), and they make big financial decisions that they might one day regret. Generally, it involves spending too much money on something because we can justify the purchase. We will say things like, “I deserve it” , “we need this”, or “I’ve worked hard for this” to rationalize the decision.

On the flip side, when we lose a friend or a loved one, have a health scare, get fired, (enter a negative emotional event of your choice), we have a tendency to make poor decisions. We find ourselves saying things like, “I can’t spend it when I’m gone” or “we only live once” or “might as well enjoy it while I have it.”

Now, back to my visual masterpiece. The goal is to make financial decisions in what I call the “financial calm zone” (the green zone). This is the zone where we can still feel the emotion but we are able to balance emotion with cognition (higher level thinking). This is where we tend to make smarter decisions.

So how do we get there?

What you can do - getting back to the “financial calm zone”

The process of regulating our emotions and making better decisions is simple…but it ain’t easy. This will take some work, but it will pay off.

This is something I learned in my class to become a master certified life coach. They call it going through an emotional audit. Also, credit to Dr. Relly Nadler for the framework.

When you are experiencing a strong emotional reaction (again, you can substitute a stressful situation), you can work through these five questions to bring yourself back in line with your “calm financial state” to make better decisions.

What am I thinking? This will help you integrate your feelings and thoughts.

What am I feeling? This falls under the “labeling affect” or the idea that you need to “name it to tame it.”

What do I want now? This helps you reflect on your current desires and connect your thinking brain to the emotion.

How am I getting in my way? This is primarily about learning from your mistakes and understanding how emotions can be big blockers to better decision making.

What do I need to do differently now? This is about taking your next step forward and growing from the experience.

The goal isn’t perfection from day one. The goal is to consistently apply this framework of questions to reflect on what you are truly feeling and thinking.

Remember the quote from the beginning?

“You aren’t responsible for your first thought but you are responsible for your second thought and first action.” - Kristen Bell

Your first thought is often the one that has been hijacked by the amygdala which means it will often lead to unhealthy, and regrettable, choices. That first thought isn’t you and it isn’t your truth. However, acting or not acting on that first thought is your responsibility.

With practice, you can learn to process it and move onto a more intentional second thought. From there, you’ll find that your actions can take your money and your life to a whole new level.

Cheers to health, wealth, and the good (financial) life,

Brent